Monroe County Estate Planning Attorney Secure Your Legacy in Monroe County,

Michigan

Protect what you have built and ensure that your wishes are honored. At The Boora Law Group, P.L.C., we help Monroe County families and small business owners create clear, practical, and legally sound estate plans — including Wills, Trusts, Powers of Attorney, and Probate planning — so your loved ones are protected and your affairs are handled exactly as you intend.

Whether you are planning for the first time or updating an existing plan, our legal team will guide you through every step so you can focus on what truly matters.

Call us today at (734) 790-3909 to schedule a no-cost, obligation-free consultation.

Why Estate Planning Matters in Michigan

Estate planning organizes how your assets, healthcare decisions, and guardianship choices are handled if you become unable to make decisions or pass away. Without a proper plan, Michigan’s probate and intestacy laws may determine the outcome — leaving important decisions to the courts instead of your family.

A well-structured estate plan can:

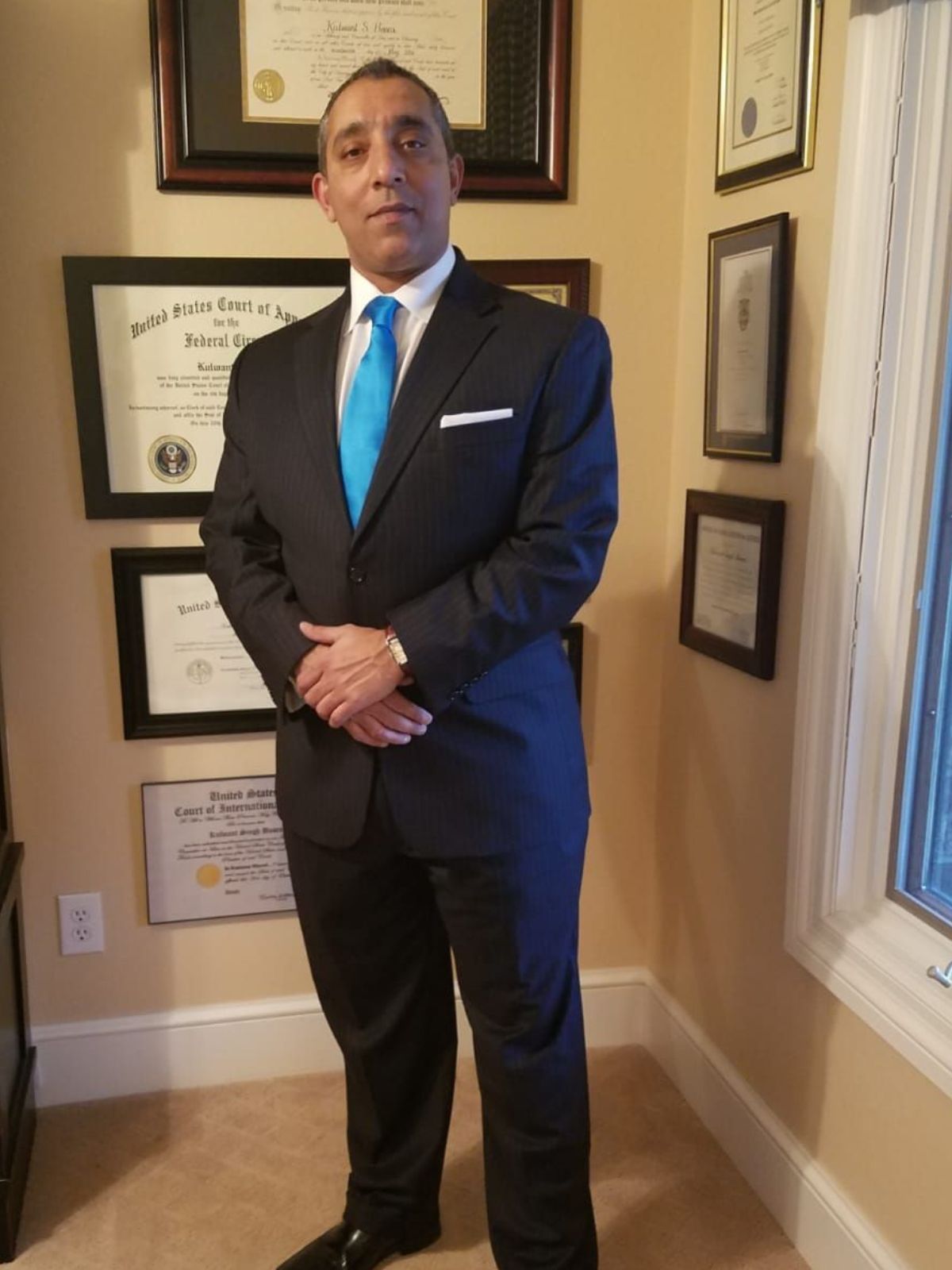

The Mr. Boora is known for his personal approach, legal precision, and genuine concern of his clients' long-term health.

- Reduce probate delays

- Minimize family disputes

- Protect both immediate and long-term needs

- Provide clarity and peace of mind for your loved ones

At The Boora Law Group, P.L.C., we ensure your estate plan is complete, legally compliant, and aligned with the laws of the State of Michigan.

Why Choose The Boora Law Group

Local Monroe County Experience

We understand local courts, probate procedures, clerks, and Michigan estate laws, helping you avoid delays and unexpected complications.

Clear, Plain-Language Guidance

We explain your options in simple terms so you can make confident and informed decisions.

Flat-Fee, Transparent Pricing

You will know the full cost upfront — with no hourly billing and no hidden fees.

Complete Support

From drafting and signing to witness coordination and secure document storage, we handle every detail.

Free Initial Consultation

No obligation — just honest, professional advice about your estate planning needs.

Our

Process

Free Consultation

We discuss your family situation, assets, concerns, and long-term goals.

Information Gathering

We collect the necessary financial details, titles, beneficiary information, and any special instructions.

Drafting Your Documents

We prepare custom Wills, Trusts, Powers of Attorney, and healthcare directives based on your specific needs.

Review & Revisions

You review every document, and we make revisions until everything accurately reflects your wishes.

Execution & Witnessing

We ensure each document is properly signed, witnessed, and executed according to Michigan law.

Secure Storage & Future Updates

We guide you on safeguarding your originals and updating your plan as life circumstances change.

Key Michigan Estate Planning Facts

- Intestate Succession

If you pass without a Will, Michigan law dictates how your estate is distributed — which may not align with your wishes.

- Witness Requirements

Michigan Wills must be signed by you (the testator) and witnessed by two individuals. Self-proving affidavits help streamline probate.

- Trusts & Probate Avoidance

A properly drafted Living Trust can help avoid or reduce probate, making the asset transfer process faster and less stressful for your beneficiaries.

Understanding these rules ensures your plan is legally valid and protects your family from unnecessary complications.

Key Michigan Estate Planning Facts

Intestate Succession

If you pass without a Will, Michigan law dictates how your estate is distributed — which may not align with your wishes.

Witness Requirements

Michigan Wills must be signed by you (the testator) and witnessed by two individuals. Self-proving affidavits help streamline probate.

Trusts & Probate Avoidance

A properly drafted Living Trust can help avoid or reduce probate, making the asset transfer process faster and less stressful for your beneficiaries.

Understanding these rules ensures your plan is legally valid and protects your family from unnecessary complications.

Service Areas

Our law firm is proud to serve our clients throughout Monroe County, Lenawee County, and counties throughout the State of Michigan Michigan, such as, but not limited to:

Our law firm is proud to serve our clients throughout Monroe County, Lenawee County, and counties throughout the State of Michigan Michigan, such as, but not limited to:

If you searched “Estate Planning Attorney Monroe County MI” or “Monroe County Wills & Trusts Lawyer,” you’ve found the right team.

Meet Your Attorney

Attorney Kulwant S. Boora, Esq.

Founder & Managing Attorney, The Boora Law Group, P.L.C.

Attorney Kulwant S. Boora is dedicated to helping Michigan families protect their assets, plan for the future, and gain peace of mind. With years of experience in estate planning and probate law, he combines legal expertise with a compassionate, client-first approach.